Wed 28 Feb 2024 • World Coffee Portal

5 Dynamics Shaping the UK Branded Coffee Shop Market in 2024

SHARE THIS POST

Brought to you by 5THWAVE

2023 saw the £5.3bn ($6.6bn) UK branded coffee shop market exceed 10,000 outlets for the first time and achieve sales growth well above pre-pandemic levels. However, operators remain cautious amid the ongoing cost-of-living crisis and lower footfall at traditionally busy high street and city centre locations. Based on exclusive data from the Project Café UK 2024 report, 5THWAVE delves into the vital statistics shaping Europe’s largest coffee shop market in the year ahead

The enduring appeal of coffee shop culture in the UK has enabled the branded coffee shop market to weather weakened consumer confidence, high inflation and growing competition over the last 12 months. Project Café UK 2024 shows the £5.3bn ($6.6bn) UK branded coffee shop market achieved 9.2% sales growth in 2023, expanding 3.6% to reach 10,199 outlets.

However, while total sales are above pre-pandemic levels, weakened consumer confidence, high inflation and lower footfall at traditional prime locations have contributed to slowed growth and increased uncertainty.

World Coffee Portal forecasts the total branded coffee shop market will exceed 10,500 outlets by January 2025, and more than 11,600 by January 2029 at five-year outlet growth of 2.7% CAGR. Sales are expected to exceed £7.2bn over the same period, representing five-year growth of 6.2% CAGR.

Monmouth Coffee in London. Marketwide price rises are challenging coffee’s status as an affordable luxury in the UKPhoto credit: Courtesy of Monmouth Coffee

1 / CHALLENGING ECONOMY CONSTRAINS GROWTH

While the cost-of-living crisis has eased slightly over the last 12 months, consumer spending remains constrained, with stubbornly high inflation eroding out-of-home coffee’s affordable luxury status.

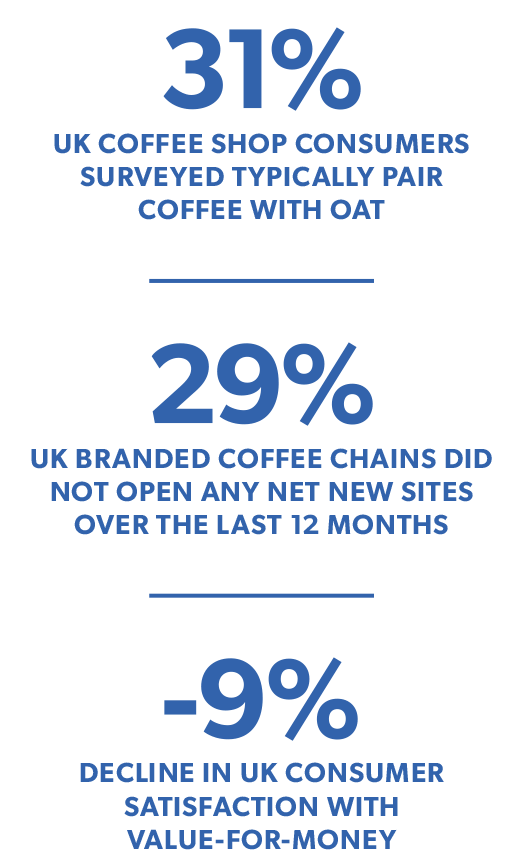

Amid sustained high product, labour, energy and property costs, branded coffee chains have increased coffee prices by an average of around 9% over the last 12 months – mirroring a 9% fall in consumer satisfaction with value-for-money. Average spend also fell 4% year-on-year, with consumers more likely to purchase a beverage only or spend less overall on food items.

Indicating that UK operators are increasingly assessing underperforming sites, a quarter saw net reductions in their outlet portfolios over the last 12 months, with 29% not opening any net new outlets. However, highlighting the easing of inflationary pressures over the last 12 months, the proportion of industry leaders describing trading conditions as ‘positive’ rose 12% to reach 49%.

Nevertheless, nearly half of industry leaders surveyed by World Coffee Portal do not believe the challenges of the cost-of-living crisis have eased for their business. While visit frequency among regular coffee shop customers has remained stable, less frequent consumers appear more willing to forego an occasional coffee shop purchase. Subsequently, sluggish sales have compelled many operators to scale back expansion and focus on higher-performing outlets.

Costa Coffee and Caffè Nero posted steady sales growth in 2023, however, net outlet expansion for both chains stalled. While Costa Coffee continues to close underperforming stores, Caffè Nero has sought to maximise the performance of its existing estate through a major refurbishment programme and the expansion of food and beverage delivery.

Highlighting a sustained footfall decline in footfall at major city centres and high streets, in July 2023 Pret A Manger reported that more than half of new outlets opened since January 2022 were outside of London, with weekend sales increasing 271% during the period. The coffee and food-to-go chain has also sought to lock in revenues with its £30 ($37.40) monthly in-store food and beverage subscription – now a key sales channel for the operator.

Starbucks also forged ahead with outlet expansion in 2023. However, in a bid to maximise operational efficiency, in March 2023 the Seattle-based coffee chain’s largely franchised UK business announced 100 planned stores would focus on smaller ‘digitally forward’ and drive-thru sites amid a ‘cautious’ outlook on the macro-economic environment.

These trading pressures have led to high-profile losses over the last 12 months. Healthy food and beverage chain Crussh, bakery-café operator Le Pain Quotidien, coffee-focused operator Triple Two and The Gentlemen Baristas all entered administration – despite the latter three brands all reporting positive outlooks in early 2023.

Canada’s Tim Hortons launched a new UK franchise model in 2023 expected to deliver 20-25 new stores per year with a mix of high street and drive-thru outletsPhoto credit: Courtesy of Tim Hortons

2 / UK OPERATORS FRANCHISE TO DE-RISK EXPANSION

Amid high costs, lower consumer spending and increased competition, UK operators are increasingly mitigating the investment risks of outlet expansion through franchising. Around 40% of Costa Coffee’s 2,670 UK stores are franchised, with the largest franchise operator, Scoffs Group, managing around 114 outlets. With a required investment of around £800,000, Costa keeps the barrier to entry high to attract tried and tested franchisees. Nevertheless, the benefits of outsourcing outlet growth, particularly in non-city centre locations, are making franchising increasingly attractive to UK operators.

Food-to-go and coffee chain Greggs opened its 500th franchised store – and 100th within 12 months – in December 2023. Greggs also kickstarted a new franchise agreement with SSP Group in May 2023 – with licensed stores now comprising around 20% of the bakery chain’s 2,450 UK stores.

In the specialty segment, Cheltenham-based franchise operator Moonglow Trading raised significant investment to open four Black Sheep stores in Cardiff and Oxford and is exploring further opportunities for the brand outside of London.

International operators remain the main drivers of franchise growth in the UK. Around 70% of the Starbucks 1,150-plus UK stores are franchised, with multi-unit licensees 23.5 Degrees, KBeverage, The Magic Bean Co. and Cobra Coffee planning to open hundreds of outlets over the next five years.

In June 2023, Naples-based Cafè Barbera announced it was seeking multi-unit franchisees to grow its three-store UK portfolio with a further 30 coffee shops by 2033. The following September, Canada’s Tim Hortons launched a new franchise model expected to deliver 20-25 new stores per year with a mix of high street and drive-thru outlets.

Australia’s Urban Baristas is also seeking UK franchisees to grow its 12-store London portfolio by adding 30 new sites within the next three years. Meanwhile, fellow Australian coffee chain Funk Coffee + Food is seeking a master franchisor to make its UK debut. Hailing from the US, in July 2023 Duck Donuts signed a franchise agreement to open four stores in Northern Ireland.

Despite the benefits of mitigating risk and tapping into local market expertise, improperly managed franchises can compromise brand integrity where procedures and quality standards are not met or relationships sour. Brand owners will also only see limited returns from royalties compared to company-operated stores.

A WatchHouse coffee shop in Bath, the boutique operator’s first outside of LondonPhoto credit: Courtesy of WatchHouse

3 / UK BOUTIQUE OPERATORS REACH NEW HEIGHTS

The UK specialty coffee shop segment has steadily developed over the last decade as consumer sophistication grows and demand for higher quality beverages gains mainstream appeal. This has enabled prominent specialty coffee operators to attract new investment while achieving unprecedented outlet, e-commerce and wholesale growth over the last 12 months.

Founded in 2014, WatchHouse now operates 16 locations in London and in December 2023 opened its first international site in New York. In January 2024, the specialty coffee group announced the completion of a £7.9m ($10m) funding round to scale its US footprint, open its first UK store outside of London in Bath and grow its e-commerce business.

After diversifying into café, bar and casual dining and retail packaged coffee, fellow London-based boutique operator Grind completed a fresh £15m ($17.1m) investment round in March 2023 and acquired ready-to-drink (RTD) business Bottleshot Coffee, citing huge opportunities in the UK’s ‘underdeveloped’ RTD coffee segment.

Further highlighting the UK capital’s thriving specialty coffee market, Finca Coffee Roasters, Kiss the Hippo, Ozone Coffee Roasters and Toast all reached or exceeded five outlets in 2023 to graduate from World Coffee Portal’s definition of an independent to a branded coffee chain.

The success of specialty operators outside of London also underlines the UK segment’s growing maturity and national reach. Founded in 2012, Nottingham-based 200 Degrees opened its 20th coffee shop in mid-2023 and announced plans to double e-commerce sales and boost its wholesale revenues by 35%.

Meanwhile, Liverpool-based 92 Degrees has outlined ambitious plans to double its 11-store portfolio within the next 12-18 months after raising more than £1m ($1.2m) investment in 2023. In January 2024, 92 Degrees took the unconventional step of acquiring Liverpool-based branding agency Redefine Studio, a move it said would ‘supercharge’ the business into a ‘global brand’.

Cornwall’s Origin Coffee is also making significant strides after securing £3.1m ($3.8m) to scale its digital, direct-to-consumer, retail and wholesale channels. In 2023, the Porthleven-based B-Corp also signed a three-year deal to become the exclusive coffee supplier to The Hoxton’s eight boutique hotels in Europe.

Oat continues to grow in popularity at the expense of coconut, almond, soya and hazelnut dairy alternativesPhoto credit: Samuel Regan-Asante / Unsplash

4 / OAT OUTPERFORMS THE PLANT-BASED CATEGORY – BUT DAIRY STILL REIGNS

Lauded by baristas and consumers alike for its thick texture, neutral taste and relatively low carbon footprint, oat cemented its status as the preferred non-dairy beverage pairing in UK coffee shops over the last 12 months – and gained share at the expense of virtually all other dairy and dairy alternatives sold in coffee shops.

The proportion of UK consumers indicating they typically choose oat in coffee shops rose nearly 3% to reach 31.4% during the period. Meanwhile coconut, almond, soya and hazelnut saw 2.1%, 3.5%, 0.8% and 0.7% declines respectively during the period. Semi-skimmed milk remains the overall preferred beverage pairing in UK coffee shops but its popularity declined 3.4% to 54.3%, with whole milk the only other coffee pairing to increase share – 0.6% to 32%.

However, there has also been notable consumer push-back against the plant-based category over the last 12 months. Concerns have been highlighted about high sugar levels in some plant-based ranges, while the use of ultra-processed ingredients, such as preservatives, oils, fats, emulsifiers and artificial stabilisers, has faced growing scrutiny.

Indicating that dairy alternatives still have some way to go in toppling cow’s milk as the go-to coffee pairing in the UK, the proportion of consumers surveyed agreeing non-dairy milk should be the default pairing at coffee shops fell slightly to 19% over the last 12 months.

A Knoops store in Manchester. Bubble tea, drinking chocolate and chai operators are increasingly vying for coffee shop consumer spendPhoto credit: Courtesy of Knoops

5 / GROWING COMPETITION FROM NON-COFFEE SPECIALISTS

Seeking to build on the cultural capital and commercial success of branded coffee shops over the last 25 years, non-coffee-focused branded cafés are growing their presence in the UK. Specialist bubble tea, hot chocolate and chai chains are increasingly vying for branded coffee shop trade with a focus on hand-prepared beverages, indulgence and younger consumers. These businesses also have the potential to capitalise on a broader part of post-morning trade where coffee shop sales typically begin to slow.

Bubble tea chains Mooboo, Cupp and Chatime have achieved significant growth in the last 12 months. Meanwhile, the CEO of Taiwan’s Gong cha has described the UK coffee shop market as ‘very saturated’, with consumers seeking ‘change and variety’ expected to drive ambitious plans to scale from 13 UK stores to 500.

Buoyed by bubble tea’s appeal among younger consumers, Taiwan’s Chun Fun How and China’s Heytea both opened their first stores in the UK in 2023. In May 2023 Costa Coffee responded to this key beverage trend by becoming the first major coffee chain in the UK to introduce bubble tea.

Premium drinking chocolate is also making headway in the UK branded café market. Backed by a £8.3m investment round, Knoops is seeking to grow from 17 UK sites to 120 by 2028. Drawing on familiar coffee shop experiences, including barista-prepared beverages, table service and an indulgent pastry menu, Knoops’ single origin drinking chocolate range also takes cues from specialty coffee.

Further highlighting opportunities for indulgence-led beverages in the UK, in January 2023 Hotel Chocolat CEO Angus Thirlwell hailed opportunities in the drinking chocolate segment after posting record annual sales. Hotel Chocolat operates 52 cafés within its 133 retail stores serving hot and iced chocolate, espresso-based coffee and tea and plans to further scale its out-of-home beverage offer after being acquired by food conglomerate, Mars.

Boosted by the popularity of chai latte, chai operators are also gaining traction. Launching in Leicester in 2016, Chaiiwala now has 80 stores across the UK, including a drive-thru. Meanwhile, Karak Cha has opened 15 outlets since 2019 and is targeting 80 more by 2027, with Cha Sha and Amala Chai, operating six stores each alongside Chai Guys’ two outlets.

Project Café UK 2024 is World Coffee Portal’s latest research on the developments and trends impacting the UK branded coffee shop market.

The report includes market sizing, consumer research based on 40,000 surveys, consultations with 150 industry insiders, pricing, operator profiles and strategic analysis of the latest industry dynamics.

To purchase the report or to make an enquiry, contact:

Ruth Thompson, Head of Partnerships rthompson@allegra.co.uk +44(0)20 7691 8800